Adipisci necessitatibus quisquam et saepe eligendi. Et sed debitis voluptates praesentium est iure natus. Qui earum saepe nesciunt corporis voluptas....

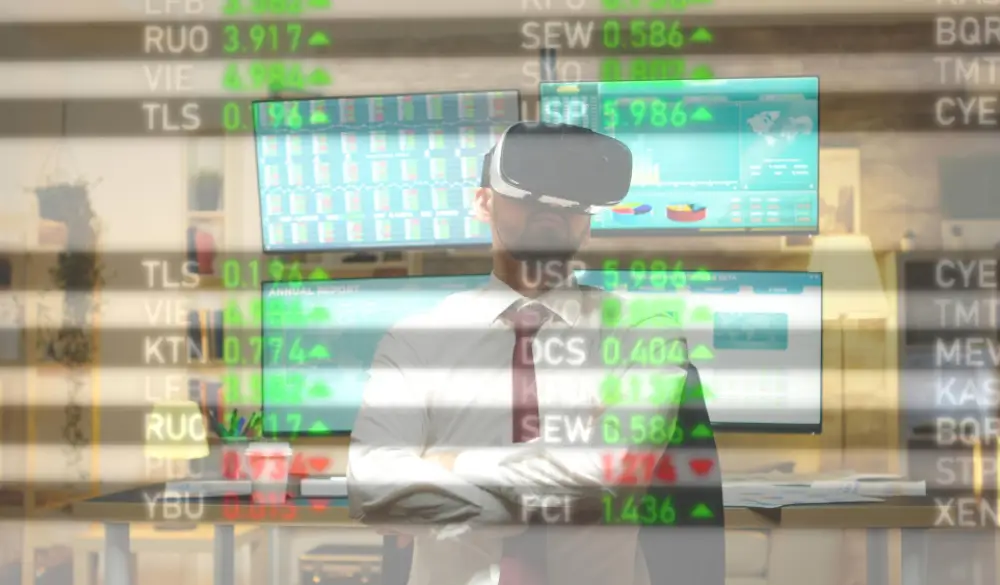

“At The Kolai, we combine data, strategy, and execution to help investors navigate complex markets with clarity, discipline, and an unwavering focus on risk-adjusted performance.”

We specialize in data-driven strategies across gold futures, cryptocurrency, foreign exchange, and fund evaluation. Our approach combines technical precision, deep fundamental research, and automated systems to uncover market opportunities and manage risk. From advanced arbitrage models to on-chain analysis and portfolio optimization, we focus on building high-performance trading and investment frameworks. Our team brings together expertise in quantitative finance, economic analysis, and algorithmic trading to support clients navigating complex global markets.

We focus on four key areas where data, strategy, and execution meet. Each business line is built on deep research, advanced modeling, and a clear goal: helping clients navigate and succeed in complex financial markets.

We deliver gold futures insights through technical analysis, macro research, risk strategies, and arbitrage models to help investors capitalize on precious metals market movements.

Our crypto strategies use data-driven portfolio models, high-frequency trading, DeFi yield analysis, and on-chain insights to maximize performance in volatile digital asset markets.

We provide forex research focused on technical indicators, central bank policy, carry trade strategies, and risk-parity modeling to support informed currency trading decisions.

We assess fund products through return attribution, manager style analysis, portfolio optimization, and fee impact evaluation to guide smarter investment choices.

Apply sophisticated quantitative modeling techniques to conduct a detailed examination of gold price movements. Focus on identifying key technical indicators, such as support and resistance levels, using historical and real-time data inputs.

Conduct comprehensive investigations into global macroeconomic trends and geopolitical developments. Assess their direct and indirect influences on the pricing and volatility of gold and related precious metals markets.

Design methodical strategies for managing position size and exposure. Use a scientific approach to set profit-taking thresholds and stop-loss limits, ensuring consistent risk-reward optimization.

Engineer arbitrage opportunities that exist between gold and various other precious metals. Focus on uncovering pricing inefficiencies across commodities to create cross-market trading advantages.

Construct diversified digital asset portfolios by applying modern portfolio theory principles. Aim to achieve a balance between maximizing returns and minimizing risk across different cryptocurrency holdings.

Build and fine-tune fully automated trading algorithms. These are specifically designed to operate efficiently in the fast-moving and volatile landscape of cryptocurrency markets.

Evaluate yield generation possibilities across various decentralized finance protocols. Assess and model the risks associated with these yield strategies to improve capital allocation decisions.

Extract actionable insights from blockchain data. Use this data to understand real-time market sentiment, track transaction flows, and monitor capital movements within the digital asset space.

Leverage a wide range of quantitative indicators to analyze the price dynamics of major currency pairs. Use these insights to uncover viable trading opportunities within global forex markets.

Conduct thorough research on central bank decisions and monetary policies. Evaluate how these policies influence currency valuations and broader exchange rate trends across economies.

Formulate currency trading strategies that capitalize on interest rate differentials between countries. Build carry trade portfolios aimed at generating returns with carefully managed levels of exposure.

Develop foreign exchange investment models based on risk parity principles. Focus on achieving balance in portfolio risk allocation by adjusting exposure across multiple currency assets.

Break down fund returns to understand what drives performance. Use quantitative techniques to attribute returns to specific factors such as market movements, asset selection, and timing.

Apply data analysis methods to uncover the underlying investment styles and behaviors of fund managers. Classify managers based on recurring patterns and tactical choices over time.

Design fund investment portfolios that aim to achieve low correlation among holdings. Emphasize portfolios with a high Sharpe ratio, focusing on risk-adjusted performance improvement.

Analyze the long-term impact of fund fees on investment returns. Study how expense ratios and performance-based fees affect the compounding of gains over extended time horizons.

"Working with their team gave us a real edge in commodities trading. The depth of their gold futures analysis was unlike anything we’ve seen. We were able to make faster, more confident decisions thanks to their models."

"Their quantitative crypto strategies have been instrumental in reshaping how we allocate capital. What stood out was their ability to simplify complex data into clear, actionable insights. They’ve become part of our long-term planning."

At the core of everything we do is a commitment to clarity, precision, and performance. In fast-moving markets, reliable insight matters. And that’s what we aim to deliver every day. Whether you’re navigating gold futures, crypto, forex, or fund strategies, our role is to help you move with confidence.

Thank you for trusting us with your goals.

Founder, Executive Chairman and CEO of Thekolai

Insights, strategies, and research from the frontlines of finance are here for you and shared to keep you informed and ahead.

Adipisci necessitatibus quisquam et saepe eligendi. Et sed debitis voluptates praesentium est iure natus. Qui earum saepe nesciunt corporis voluptas....

Sunt fugiat dolore dolor eveniet velit debitis vel maxime. Placeat autem perferendis cumque velit. Voluptatem reiciendis qui at necessitatibus impedit...

Et deleniti doloribus ducimus sint sequi quibusdam. Sed et expedita quo cumque. In temporibus quae laudantium dolorem. Porro molestias ipsum...